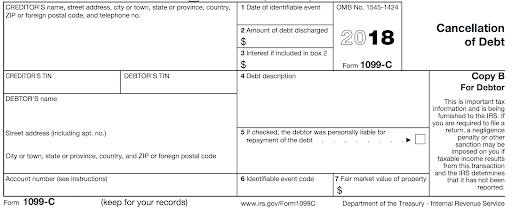

Does the issuance of a 1099-C discharge debtors from liability? The answer is no, the issuance of a 1099–C does not discharge debtors from liability from the subject debt. The filing of a Form 1099–C is a creditor’s required means of satisfying a reporting obligation to the IRS; it is not a means of accomplishing an actual discharge of debt, nor is it required only where an actual discharge has already occurred.

The fact situation is simple and straightforward. A creditor who has loaned money to a debtor makes an internal decision to “write off” of the debt on its books. At that point in time, the creditor is required by IRS regulations to report the write-off.

While only a handful of courts across the United States have addressed this issue, most have arisen in the context of a bankruptcy. Almost every court that has addressed the issue and the few reported decisions in Texas have concluded that the issuance of a 1099–C does not discharge debtors from liability of the subject debt.

The most thorough analysis of the issue and most cited opinion is In re Zilka, 407 B.R. 684 (Bankr. W.D. Pa. 2009), a bankruptcy decision from Pennsylvania. The Court in In re Zilka found four separate independent legal basis upon which to hold that the issuance of a 1099–C does not discharge debtors from liability. The four legal bases are as follow:

- The IRS requires the issuance of a 1099-C. 26 U.S.C. § 6050P(a) provides, in pertinent part, that “[a]ny applicable entity which discharges . . . the indebtedness of any person during any calendar year shall make a return . . . setting forth . . . the name, address, and TIN of each person whose indebtedness was discharged . . . [as well as] the date of the discharge and the amount of the indebtedness discharged.” The information return just referred to is a Form 1099–C.

However, “a discharge of indebtedness” is “deemed to have occurred . . . if and only if there has [been] an identifiable event described in paragraph (b)(2) of this section, whether or not an actual discharge of indebtedness has occurred on or before the date on which the identifiable event has occurred.” 26 C.F.R. § 1.6050P–1(b)(2) sets forth eight identifiable events that can trigger the filing and issuance of a Form 1099–C, among which is “(G) [a] discharge of indebtedness pursuant to a decision by the creditor, or the application of a defined policy of the creditor, to discontinue collection activity and discharge debt.”

- The IRS does not view a Form 1099–C as an admission by the creditor that it has discharged the debt and can no longer pursue collection. In an IRS Information Letter issued in October 2005 it addressed concerns regarding the impact of a creditor’s compliance with the Form 1099–C reporting obligation and the continuing liability of a debtor on the subject debt. The IRS assured a concerned creditor that filing a Form 1099–C satisfies the reporting requirements of the statute and implementing regulations, neither of which “prohibit collection activity after a creditor reports by filing a Form 1099–C.”

- That a Form 1099–C does not constitute an admission by the creditor that it has discharged the debt and can no longer pursue collection thereon is consistent with the fact a creditor can issue a corrected Form 1099-C if a recovery of some or all of the monies owed by the debtor subsequently occurs. In another IRS Information Letter issued in October 2005, the IRS responded to a creditor that it “does not view a Form 1099–C as an admission by the creditor that it has discharged the debt and can no longer pursue collection.”

- The issuance of a Form 1099–C does not constitute one of the means of discharging debt pursuant to the Uniform Commercial Code, § 3.604 governs Negotiable Instruments. Section 3.604 of the Tex. Bus. & Comm. Code, Discharge by Cancellation or Renunciation provides that: (a) A person entitled to enforce an instrument, with or without consideration, may discharge the obligation of a party to pay the instrument:

(1) by an intentional voluntary act, such as surrender of the instrument to the party, destruction, mutilation, or cancellation of the instrument, cancellation or striking out of the party’s signature, or the addition of words to the instrument indicating discharge; or

(2) by agreeing not to sue or otherwise renouncing rights against the party by a signed record.

The most recent Texas court to address the issue was Capital One, N.A. v. Massey, No. 4:10 CV–01707, 2011 WL 3299934 (S.D. Texas Aug. 1, 2011) wherein the United States District Court for the Southern District of Texas “adopt[ed] the view that a 1099–C does not discharge debtors from liability” because the form is “issued to comply with IRS reporting requirements” and the IRS does not view it “as a legal admission that a debtor is absolved from liability for a debt.”

Lasting, pursuing collection of a debt that has been written off and reported on a 1099-C does not violate Tex. Fin. Code § 392.304(a)(8) which prohibits the collection a debt that was “discharged and/or extinguished against them.”